The Hack: Treating Income as Negative Expenses

#Quicken 2017 budget how to

With its ability to import transactions from financial institutions, MS Money essentially replaced receipts as my system of record.Įnter the challenge: How to get rid of my manual Excel budget and use the automated tools at hand so I could spend less time keeping track of our money? I found a solution in MS Money, and later in Quicken, by treating my paycheck in an unusual way.

#Quicken 2017 budget software

I made the (partial) switch to financial software when Microsoft started giving away copies of Microsoft Money with Windows ’95. I used receipts to track expenses (which occasionally left gaps when we would misplace a receipt or not get one at all), and then updated the envelope balances in Excel each week. With a simple balance report, I knew at a glance exactly how much money was available for Gas, Groceries, and every other budget line at any time.Įarly-on, I kept track of our envelope budget in Excel.

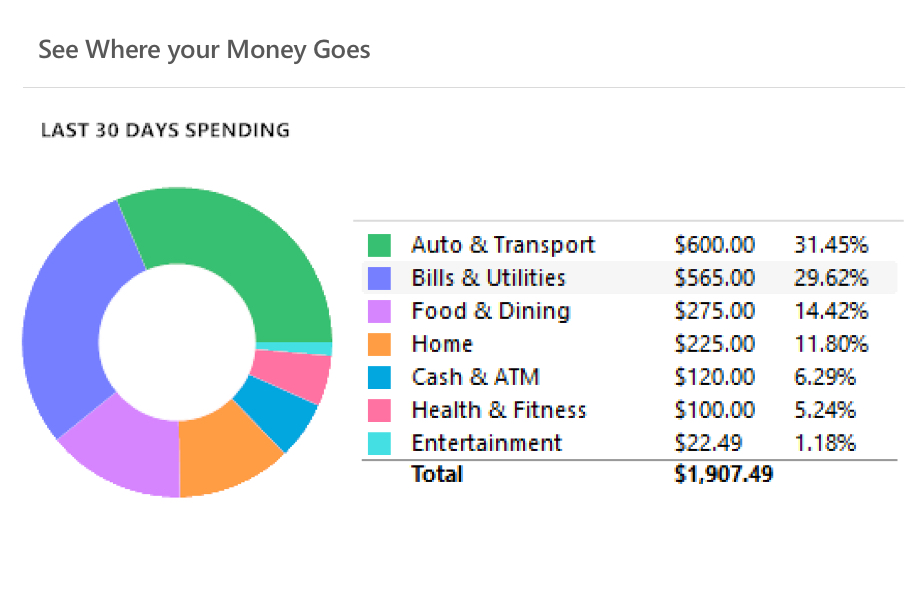

Micro-explanation: you spend only what you actually have on-hand.Įven after getting to the point that I could have a month’s expenses available in advance – when a classic budget could be functional – I still loved the simplicity of the envelope system. We lived in that reality for many years before getting our personal finances under control using a stone-age method: envelope budgeting. Financially, we began spiraling downward into significant credit card debt. If our balance was insufficient we would use credit (and pray to God there were no NSF charges from some forgotten expenditure). Like many, we lived by our checkbook balance. That basic problem – trying to live by a budget when the money isn’t available in advance – caused us a lot of trouble early in our marriage. Anyone basing personal finance decisions on a simple budget report can find themselves in hot water quickly. Almost 60% of Americans live paycheck-to-paycheck, according to a 2019 Charles Schwab survey. The problem for most people is that they don’t have that whole $204.82 available on day one of any given month. If I set that amount as my monthly budget on day one of this year, I could spend $204 on the first day of the month and our home finance software would happily tell me I am under budget. Looking back over last year, I can see that Christina and I spent an average of $204.82 per month on gas.

Let’s say I want to have a budget for gas for our two cars. For anyone just beginning budgeting, that is a disaster in the making. I have always had a simple problem with home finance and budgeting software: It doesn’t care whether you have money in the bank or not.

0 kommentar(er)

0 kommentar(er)